Business Insurance in and around Brandon

Brandon! Look no further for small business insurance.

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

Sometimes the unpredictable is unavoidable. It's always better to be prepared for the unfortunate mishap, like an employee getting injured on your business's property.

Brandon! Look no further for small business insurance.

Cover all the bases for your small business

Customizable Coverage For Your Business

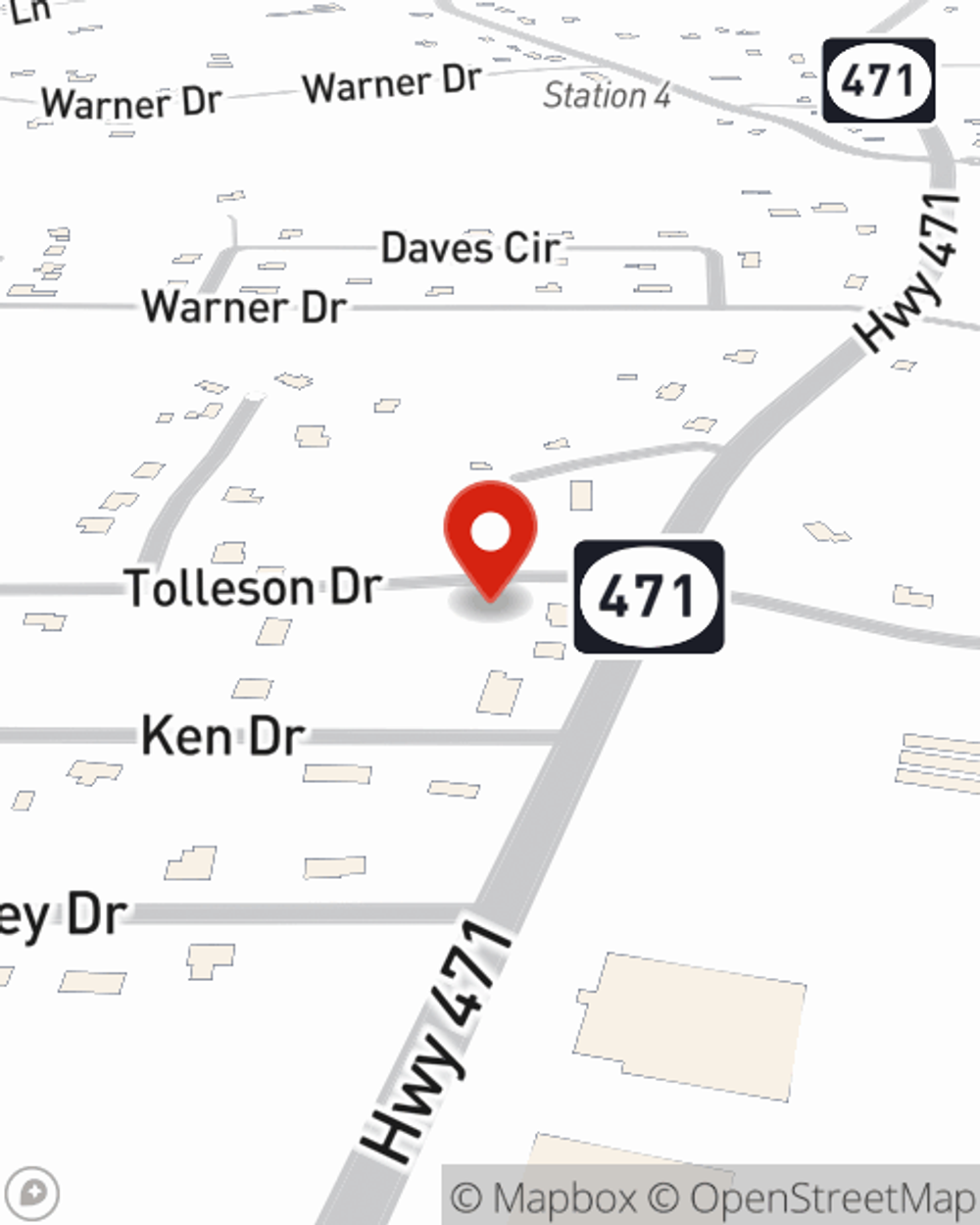

With State Farm small business insurance, you can give yourself more protection! State Farm agent Phillip Pace is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Phillip Pace can help you file your claim. Keep your business protected and growing strong with State Farm!

So, take the responsible next step for your business and call or email State Farm agent Phillip Pace to explore your small business insurance options!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

Phillip Pace

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.